5 Ways to Financially Prepare You For divorce

Untangling two people's money is messy. Long before spousal or child support is awarded, you'll need to prepare your finances for the work ahead.

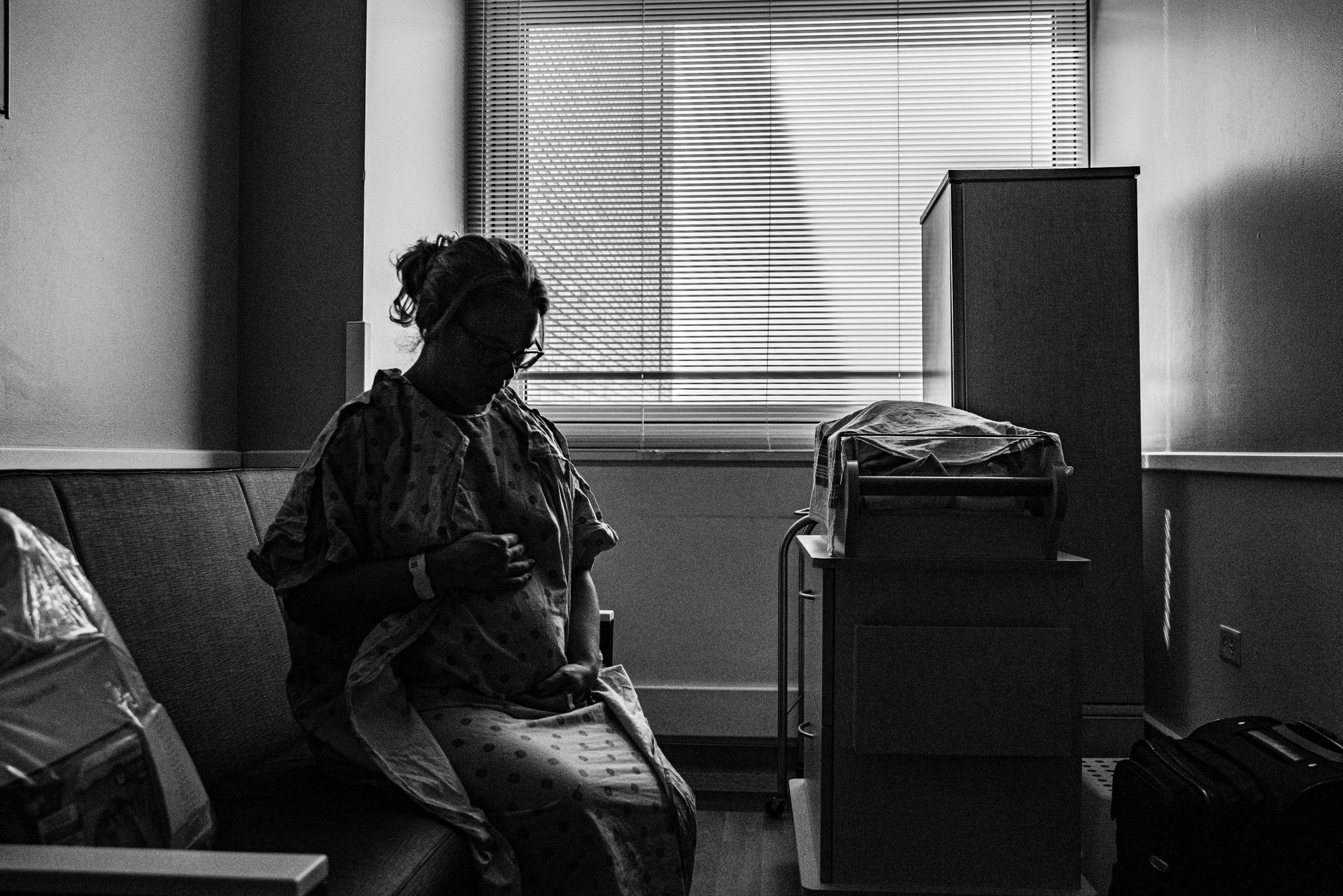

Marriage counseling alone is insufficient for some couples to stave off divorce. It's a difficult process that drains both the participants' financial and emotional resources.

Untangling two people’s money is messy. Long before spousal or child support is awarded or your post-divorce budget is in place, you’ll need to prepare your finances for the work ahead. Wading through the legal issues of separating your finances at the same time that you are separating a life together adds stress to an already painful time. It's important to start preparing before you submit the paperwork because you will need to make significant changes to your budget, living expenditures, and financial planning in the future. The following tips will help you prepare your finances for divorce.

Prepare and Gather Financial Documents

Once you know that a divorce is inevitable, gather any paperwork or electronic files that help to paint an overall financial picture. You can start looking into the following documents:

Checking and savings account statements (past year).- Retirement account statements (current, if contributions haven't changed).

- Investment account statements (past year).

- Ledgers for any loans, including your mortgage, auto loans, and personal loans (past year).

- Credit card statements (past year).

- Recent pay stubs.

- Lists of assets and debts brought into the marriage and those accumulated since marriage.

- Income tax returns (past three years).

- Pension information

The Institute for Divorce Financial Analysts offers a

checklist of financial records you’ll want to prepare.

All of these documents will be necessary throughout the upcoming legal proceedings. If your partner tries to stop you from getting financial information, an attorney can assist you to get a court order. The soundness of your marriage's finances is evident from your financial records. Starting early is advised because gathering these documents can be tedious and time-consuming.

Track expenses — and project for future ones

As soon as you realize divorce is unavoidable, start keeping track of your family's income and expenditures. This is essential for your lawyer and eventually the judge in determining how to divide assets and debts and whether to award spousal or child support. It will also help you create a budget after your divorce.

If you’ve already been tracking as part of your budget, even better: You have a record of past months and years. If not, start right away and list everything you spend money on, including housing expenses, food, clothing, entertainment, home upkeep, transportation, child care, and anything else. To estimate prior spending, consult your bank and credit card statements. Next, forecast future costs.

Use prior years as a guide, but keep in mind that conditions can change. For instance, if you have kids, your expenditure will shift from daycare to after-school activities, then to auto insurance, and eventually college costs.

Be conservative when spending and saving

It's difficult to separate joint money, and a lot of the procedure depends on your state's rules, some of which see all income, assets, and debts as belonging to a single pot. Emptying that pot, or even dipping into it more than usual, in the weeks and months before your divorce could be detrimental.

Use your accounts, whether they are solo or joint, as usual. Try to come to an agreement with your husband about spending a reasonable and comparable amount on each, especially if you don't have money set up for the costs of hiring a divorce lawyer and other related fees. Ask your lawyer about a formal separation if you and your partner aren't getting along because it would specify how you and your partner handle your finances until the divorce is through.

Control spending and avoid making Big Financial Changes

Before getting divorced, avoid making significant changes to your finances. Debts and assets are divided during the divorce process. A judge can view your case negatively if you make anticipatory modifications to your will, retirement plan, investments, and life insurance beneficiaries.

Making significant purchases prior to the conclusion of your divorce may qualify the purchases as joint property. Additionally, it gives the impression that you're attempting to hide assets before the divorce. Furthermore, keep track of your spouse's expenditures during this time and note any significant acquisitions.

Know when to get help

Whether your divorce is amicable or adversarial, a lawyer can help you sort through the separation of your lives and finances.

In addition to your attorney, a financial advisor can offer expertise concerning divorce's effect on your current and future financial health.

A financial advisor can help those in the midst of a divorce or even just considering it. An increasing number of people contact them to ask whether a divorce is financially feasible, sometimes even before contacting an attorney. You can also ask a financial advisor to judge the merits of your divorce settlement and how to best structure it.

Even if your divorce is more about dividing debts, it’s important to talk with a financial expert.

To avoid the added stress of planning your finances during a divorce, consult

KK Financial Solutions.

Find out how they can help you today.

Don't be afraid to lean on us for help during this tough time in your life. We can provide you with expert advice and guidance to make sure you get the best deal! And instruct you on how to use your investments to help with the down payment and closing costs.

We all need guidance on how to spend our hard-earned money wisely. If you’re looking to improve your financial picture, we’re here to help.

Check out

KK Financial Solutions.